How to get tax refund in Taiwan?

VAT Refund Guidelines for Foreign Travelers Eligible Applicants:

Foreign travelers who enter the R.O.C. with the following documents and stay for no more than 183 days from the date of Arrival:

- Passport of a country other than the R.O.C.

- R.O.C. passport without personal ID No. recorded.

- Travel documents.

- Exit & Entry permit.

- Temporary entry permit (Note: only eligible for use in claims made at an international airport or port, not applicable for on-site or designated tax refund service outside of airports or ports).

Requirements for VAT Refund:

Foreign travelers, with the entry document, who make purchases of at least NT$2,000 on the same day from the same designated stores with the “Taiwan Tax Refund”-label are eligible to request the “Application Form for VAT Refund.” To claim the refund, they must apply at the port of their departure from the R.O.C. within 90 days following the date of purchase, and they must take the purchased goods out of the country with them.

Goods Eligible for Tax-refund

The goods purchased at the designated TRS-labeled (as shown below) stores and will be carried out of the R.O.C. by the departing foreign visitors, however excluding:

- Items prohibited from being carried on board aircraft or ships for safety reasons (such as flammables, aerosols, corrosives, magnetic materials, poisonous/toxic substances, explosives, briefcases and attaché cases with installed alarm devices, oxidizers, radioactive materials, and any other articles or substances that according to the relevant regulations of the International Air Transport Association, may pose a flight safety risk when transported by air).

- Items in contravention of cabin restriction rules.

- Unaccompanied goods.

- Specific goods which have been returned, unpacked, consumed or swapped before departure.

Where to claim your refund:

- The Tax Refund Service at Airports/port terminals: Tax Refund Service Counters located at the airport/ seaport.

- On-site Small-amount Tax Refunds: Authorized “Taiwan Tax Refund”-labeled stores.

- Designated Counter for Tax Refund Service: Designated Counters for Tax Refund Service.

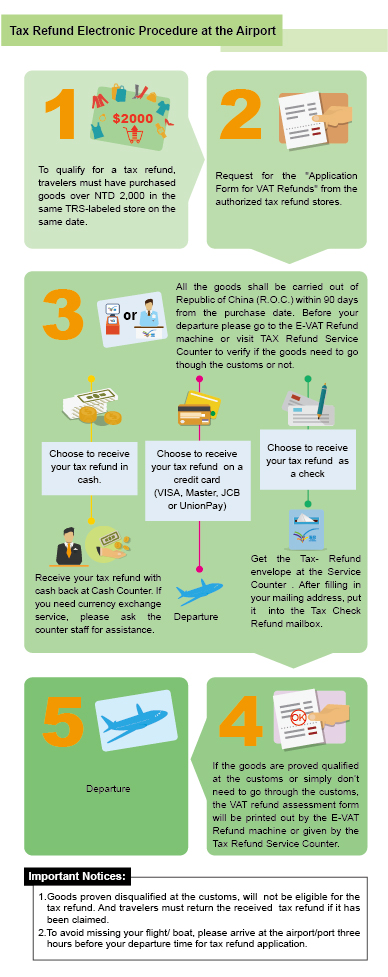

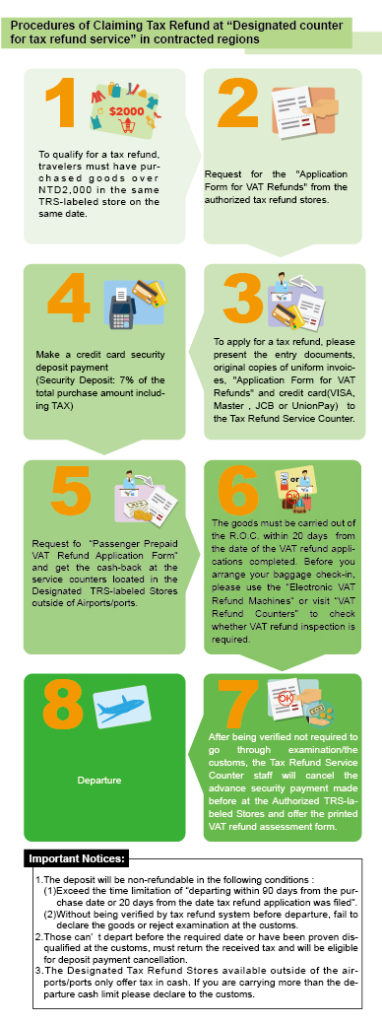

Procedures of Claiming Tax Refunds:

Before your luggage check-in, please take your passport and VAT Refund Claim Form to the E-VAT refund machine or VAT refund service counter to scan your passport and the tax refund receipts. The tax refund system will instruct you if your goods need to be examined by Customs or not.

- If your goods need to go through the Customs, the machine will print out a checklist. Please visit the customs counter with the following documents and the checklist:

- The checklist (printed by the E-VAT Refund machine).

- Tax Refund Claim Form.

- Personal documents (passport, travel documents, entry/exit permits or temporary entry permits.

- The uniform invoices noted with “tax-refundable goods” or “the last 4 digits of your passport number.”

- The goods you purchased.

- Tax refund payment method.

- You could choose to receive your tax refund through cash, credit cards (VISA, MASTER and JCB), account at UnionPay or check.

- If you choose to receive the refund “in cash”, please obtain the receipt “VAT refund application Form” printed out by the machine or given by the Service Counter and go to the designated banks or cash counters located at departure airports/ports for your tax refund.

- ATTENTION for those who use their credit cards or checks for tax refund payment.

- If you choose to receive the refund on credit cards or as checks, you may apply for the refund by transferring it to your credit card account (VISA, MASTER, JCB and UnionPay) at the E-VAT refund machine or VAT refund service counter, or you may also apply for a refund as a check at the VAT refund service counter.

Hope you enjoy your stay in Taiwan!

留言